What Technology Powers RYTM AI?

Technologically, RYTM AI is a combination of a multi-agent LLM system and custom machine learning (ML) models.

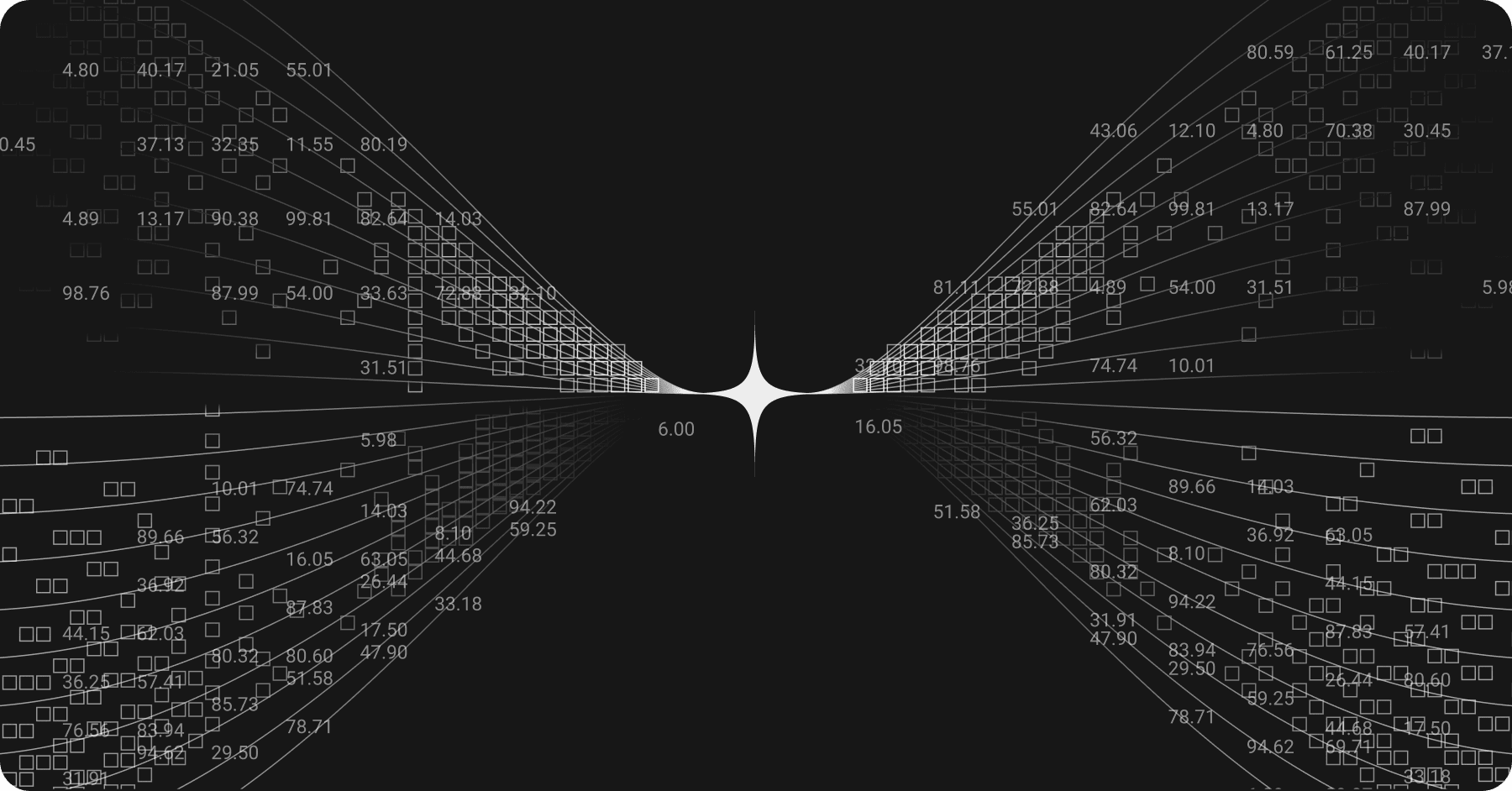

RYTM's goal is to solve one of the most challenging tasks for retail investors: processing vast amounts of financial information and extracting what truly matters. Technologically, it's a combination of a multi-agent LLM system and machine learning (ML) models.

The system workflow is divided into four critical stages, each combining specific technologies (LLM, OCR, RAG, ML):

Monitoring and Data Collection Agents

The first link in the analysis chain is data monitoring and collection. These agents track stock exchange announcements and news feeds in real time. Since a large portion of financial information is published in PDF format (quarterly reports, presentations), the agents use optical character recognition (OCR) combined with large language models (LLM) to convert unstructured documents into machine-readable text and data points.

Extraction & Reasoning Agents

To find what's essential in the raw data, we apply RAG technology (Retrieval-Augmented Generation). These agents don't just search for keywords – they analyze context to extract the real drivers of business growth and segment financial results by business unit. The goal is to identify connections between numerical metrics and qualitative information (such as management commentary).

Benchmarking Agents

A number without context has no investment value. At this stage, the system dynamically identifies the company's direct competitors from our database. The company's results are then compared against sector averages and competitor metrics to determine whether we're looking at a market leader or a laggard.

Scoring & Synthesis

In the final phase, deterministic mathematics meets generative AI. Our machine learning (ML) model calculates a quantitative score (1–10) for the stock based on the input data. The LLM then generates a human-readable, well-reasoned explanation for that score, synthesizing the findings from all previous agents into a cohesive narrative.

This architecture ensures that RYTM's analysis is both mathematically grounded and easy to understand.

All content, data, and analysis provided by RYTM are for informational and educational purposes only. They do not constitute financial advice, investment advice, or a recommendation or solicitation to buy, sell, or hold any security. You are solely responsible for your own investment research and decisions. Always consult with a licensed financial professional before making any investment.